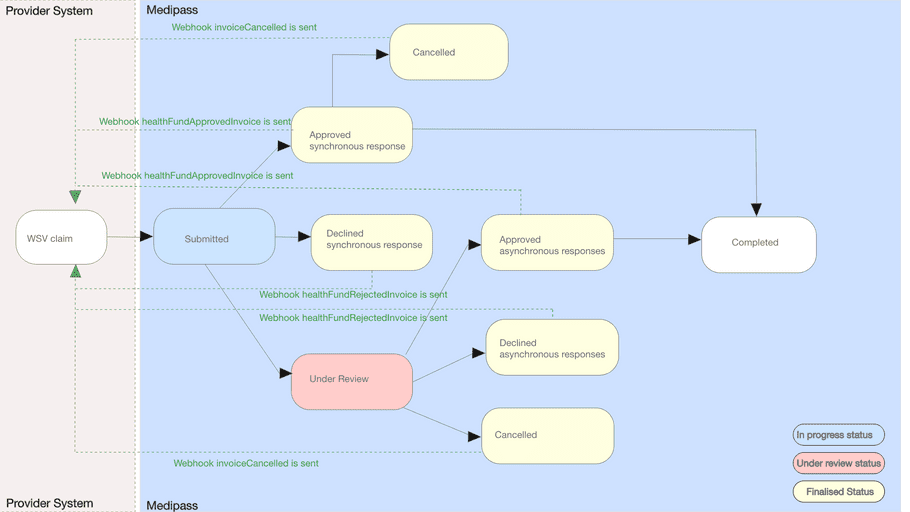

Claims processing flows

WorkSafe Victoria claims - also called invoices - will have both synchronous and asynchronous outcomes. Approximately 60% of claims are adjudicated in real-time with a synchronous response provided within 30 seconds. The remainder of claims are asynchronous, with adjudication responses hours to typically two business days from submission. Partners will need to accommodate for asynchronous responses which can be pushed from Tyro Health via webhooks or periodically polled by partners via an invoice status API.

Once a claim is submitted, the status can change as follows:

-

Outstanding : claim is under review by WorkSafe Victoria -

Approved : claim is approved for settlement -

Declined : claim was declined and will not be paid -

Cancelled : claim was canceled by the provider prior to settlement -

Completed approved claim paid/settled to provider

If multiple service items are claimed, each will have a unique item level status. Overall invoice status will change only where a final result has been obtained for each claim item. An invoice with at least one approved claim item will be marked as approved.

Once a claim is approved, payment is issued the next business day. WorkSafe Victoria utilises a 5pm AET end of day. Claims approved after 5pm AET will be included in the following business day settlement period. If multiple claims are settled for the same provider, a single aggregate payment will be made. A remittance report is issued to providers on settlement which details each claim paid. If a provider has multiple claims - even from different insurers - or card payments issued by Tyro Health in the same settlement period, those claims will be included in the same aggregated settlement.

Claim structure

In WorkSafe Victoria, patients are referred to as “injured workers”. However, the details required to claim are similar to other compensatory funders. To issue a successful claim, the following details are required in each invoice:

-

Provider, profession and practice location

: Usually set with a single provider number attribute. These details must be registered with Tyro Health in advance of a claim. Only one provider can claim per invoice.

- Patient details : including first and last name, date of birth and WSV issued claim number.

- Service items : including service date, item number and fees are required. Optional attributes can include quantity, description and other item attributes. Multiple service items from multiple service dates can be claimed per invoice.

Unlike other insurers, referral details are not required for medical specialists or allied healthcare providers. WorkSafe Victoria does not currently support invoice level notes or attachments. If an attachment is required to support a claim - such as a certificate of fitness/capacity - those details must be sent directly to WorkSafe Victoria by the provider.

Processing and settlement periods and payment of invoices

Providers can lodge WorkSafe Victoria claims 24/7.

Some claims will be processed instantly by WorkSafe Victoria using their straight-through adjudication method. Those claims will return an approved or declined status within 30 seconds and the SDK will return that status via a callback.

Invoices that are placed Under Review at the time of submission will be handled manually by a WorkSafe Victoria claims manager. This typically occurs during business hours Monday-Friday.

Once the provider's invoice has been approved by WorkSafe Victoria within Tyro Health, funds will be deposited to your nominated bank account the following business day by Tyro Health.

WorkSafe Victoria utilises a 5pm AET end of day. Claims approved after 5pm AET will be included in the following business day settlement period. If multiple claims are settled for the same provider, a single aggregate payment will be made. A remittance report is issued to providers on settlement which details each claim paid. If a provider has multiple claims - even from different insurers - or card payments issued by Tyro Health in the same settlement period, those claims will be included in the same aggregated settlement.

Reporting, statements and receipts

Tyro Health Online automatically generates patient reports, statements and receipts on behalf of the partner/providers. These reports and receipts can be obtained from Tyro Health Online provider portal or via API calls. Patient reports, statements and receipts are also created and available online in Tyro Health Online portal for patients with a Tyro Health Online member account.

Invoices are automatically generated by Tyro Health Online for each injured worker and the treatments delivered. These invoices are directly sent to Worksafe victoria's for approval. Providers can print copies of the invoice from the Tyro Health Online provider portal.

Remittance reports

Remittance reports are available on the Tyro Health Online when the payment has been made. Remittance reports will include all payments to a provider for the given settlement period which can include payments for other funding sources such as icare, Comcare and payment cards.

Eligibility checks and quotes

The WorkSafe Victoria integration provides a quote functionality that enables providers to check that a given claim number is valid and eligible to claim for the service provided, as well as the expected benefit.

Within the PMS, quotes and claims can be implemented as stand-alone features or as a single interface with the ability for the user to toggle between quote and claim mode.

Supported providers and patients

Professions and geographies

WorkSafe Victoria currently supports electronic claims from:

- General Practitioners

- Physiotherapists

- Pharmacies

WorkSafe Victoria intends to extend this service to additional professions which will be enabled by Tyro Health on notice.

WorkSafe Victoria is principally delivered by Victorian healthcare providers. However, providers from other states - typically near border towns - can register and deliver services to eligible patients.

Providers must first register with Tyro Health prior to submitting a WorkSafe Victoria claim. This registration process is self-service and can be completed within a few minutes. If providers deliver services from multiple locations or businesses, each unique provider number must be registered. Details on provider registration and WorkSafe Victoria activation is provided at: https://help.medipass.com.au/en/articles/5834449-enable-worksafe-victoria-digital-invoicing

Patients

Injured workers with a valid and active claim number can use the service.

WorkSafe Victoria has multiple external agents who help to manage claims or process employer premiums. The service has been designed to support all external agents, which include:

- Allianz

- EML

- CGU (note agent is no longer active)

- Gallagher Bassett

- TAC

- Xchanging

Details of agents can be returned in successful claims.

Though rare, patients may have more than one active case. In this event, the patient will have a unique claim number for each active case.